Contents

Many economists realized that Ricardo’s theory of comparative advantage seems to be more reliable as compared to H-O Theory in predicting the various trade patterns with accuracy. Leontief made use of 1947 input-output tables related to the U. 200 groups of industries were consolidated into 50 sectors, of which 38 traded their products directly on the international market. He took only two factors of production— labour and capital.

To assess whether the United States was exporting capital-intensive items and importing labour-intensive goods as the theory would suggest, Leontief examined trade statistics from 1947. He made use of input/output tables for replacing American exports and imports. Buchanan has criticized Leontief for having neglected the role of natural resources in the determination of trade pattern. Capital and natural resources are complementary in many fields of production. Although capital is relatively abundant in the United States, yet it may be less effective because that country is relatively under- supplied with natural resources and it may not be able to make full use of its capital.

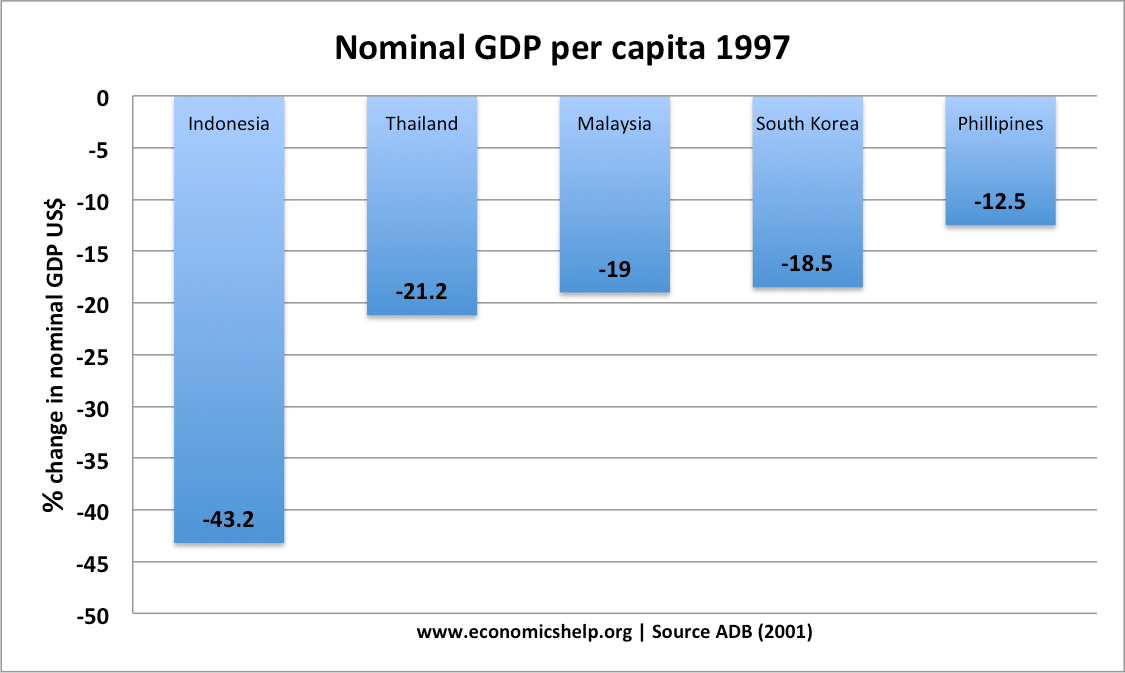

Therefore, nations with a lot of capital should be able to create capital-intensive commodities fairly cheaply and export them to cover the cost of importing goods that require a lot of labour. Additionally, it highlights the importation of items that a country cannot produce as effectively. It advocates for nations to export commodities and resources they have an excess of while proportionately importing those resources they require. Some nations have a relatively high level of capital, which means that the average worker has access to a wide range of tools and machines to help with the job.

Assumptions made by the Heckscher Ohlin theory of international trade about the world economy

The novel hypothesis put out by Heckscher and Ohlin probed the fundamental factors that influence variations in comparative costs. They clarified that the disparities in comparative costs are due to variances in the factor endowments of various countries and the various factor ratios required to produce various commodities. Therefore, the Heckscher-Ohlin theory of international trade is the name given to this novel theory.

Secondly, India relied heavily on the imports of food grains and many other consumer products from the United States until 1970’s. That accounted for high labour-intensity of her imports from the United States. Thirdly, there is a substantial direct foreign investment by MNC’s owned by the United States and the European countries in India and other LDC’s. Despite these recommendations, economists continued to maintain the validity of the paradox. The Heckscher-Ohlin-Vanek theorem, which predicts that countries will export merchandise which are made from factors in great provide, performs poorly. His early critiques of Keynes’s General Theory made essential contributions to the Neo-Keynesian synthesis’ stress on mounted nominal wages in interpreting Keynes’s theory.

The Leontief paradox can be valid in the case of United States, if it is assumed that the consumption pattern in that country is very strongly biased in favour of capital-intensive goods. Brown revealed that the consumption or demand pattern in the United States did not appear to be biased in favour of capital- intensive goods. Thus Leontief paradox cannot be justified even on the basis of differences in demand or consumption pattern. A 1957 study concluded by Houthakker about the consumption patterns in many counties showed that the income elasticity of demand for food, clothing, housing and several other goods was strikingly similar across nation. Consequently, the explanation of Leontief paradox in terms of taste differences cannot be accepted.

Comparative cost advantage

Others have defined the paradox by reducing the significance of comparative advantage as a determinant of trade. For example, demand could play a extra necessary position than comparative benefit as a determinant of trade—with the speculation that countries which share similar demands will be more more likely to commerce. For instance, each the United States and Germany are developed nations with a significant demand for automobiles and each have giant automotive industries. Since 1933, the Heckscher-Ohlin model has been a particularly popular hypothesis of global trade. Since then, a large number of economists have examined the theory’s applicability to statistics on global commerce.

- Using trade statistics from 1962, Robert Baldwin discovered that American imports required 27% more capital than an American export.

- The theorem simply states that as countries transition to free trade and the prices of the output goods are equalised between them, the prices of the factors will also be equalised.

- Firstly, these countries depend greatly on the technology imported from the advanced countries, as they do not themselves have an indigenous technology suited to their own factor endowments.

- Prices of variables like raw materials, labour, etc., are ultimately dependent on the demand and prices of finished items because the desire for them is the derived demand.

Fourthly, there is factor price distortion in the LDC’s, i., the factor prices existing in these countries do not necessarily reflect their factor proportions. He modeled each sector with a linear equation primarily based on the data and used the computer, the Harvard Mark II, to solve the system, one of many first vital uses of computers for mathematical modeling . Leontief set up the Harvard Economic Research Project in 1948 and remained its director till 1973. Starting in 1965 he chaired the Harvard Society of Fellows. The dialogue of the Leontief paradox has hardly been able to establish firm conclusions.

Input-output was novel and inspired large-scale empirical work – and has been used for economic planning throughout the world – whether in Western, Socialist or Third World countries. Input-output inspired the analysis of linear production systems – which were instrumental in the development of modern Neo-Walrasian theory, particularly at the Cowles Commission. In International economics, “The Heckscher-Ohlin theory” is considered to be one of the most influential theoretical concepts. Since the theory makes a few simplifying assumptions, it is preferred over Ricardo’s Theory by most economists. The theory has been subjected to many empirical tests because of its influence on the scenario of international trade.

Overall, there has been a net improvement in the community’s welfare. Unusual for most economic contributions, Leontief’s system was also crucial for the formal development of the rival Classical theory. The structure of input-output was employed by Piero Sraffa and the Neo-Ricardians in the 1960s to resurrect the theories of Ricardo and Marx. This was the other of what economists anticipated on the time, given the high stage of U.S. wages and the comparatively high amount of capital per employee within the United States. Both imports and exports grew significantly as a share of GDP.

National competitive advantage

They attributed such a trade pattern to the fact that almost 75 percent of Japan’s exports were directed to the Third World countries which were more capital- scarce that Japan. From their viewpoint, Japanese exports to them were capital-intensive. In contrast to the United States, Japan was labour- abundant and capital-scarce. Consequently her exports to the advanced countries like the United States had a lower capital-labour ratio. In this way, their findings confirmed the validity of H-O theory. In 1980 Edward Leamer questioned Leontief’s unique methodology for evaluating factor contents of an equal greenback worth of imports and exports (i.e. on real trade fee grounds).

His early reviews of Keynes’s General Theory were important stepping stones to the Neo-Keynesian synthesis’s stress on fixed nominal wages in interpreting Keynes’s theory. In view of this, it is not surprising that the labour- abundant United States exports those products, which have relatively greater labour-intensity. There is no doubt that the productivity of labour is higher in the United States than in other countries. But the multiple of three, as assumed by Leontief was clearly arbitrary. In a study conducted by Kreinin in 1965, it was revealed that the productivity of American labour was more than that of the foreign labour only by 20 to 25 percent and not by 300 percent. According to these writers, this pattern of trade is not consistent with the H-O theory.

The capital/labour ratio is the portion of capital to labour employed in a production that is described in the Heckscher-Ohlin model. Thus, the capital/labour ratios of various industries producing various items will vary. Each nation produces two items in the model, hence it must be assumed which industry has a higher capital-to-labour ratio.

I am truly Statisfied with study material of Eduncle.com for English their practise test paper was really awsome because it helped me to crack GSET before NET. I recommend Eduncle study material & services are best to crack UGC-NET exam because the material is developed by subject experts. Eduncle material consists a good no. of ques with online test series & mock test papers. The General Aptitude part of Eduncle study materials were very good and helpful. Time management is very much important in IIT JAM. The eduncle test series for IIT JAM Mathematical Statistics helped me a lot in this portion. I am very thankful to the test series I bought from eduncle.

One way to translate these model results into reality is to claim that, to the degree that nations have comparable production capacities, factor prices will tend to converge as freer trade is achieved. The value of a factor of production’s marginal productivity determines the return on investment in a market with perfect competition. The amount of labour being employed and the amount of capital both affect a factor’s marginal productivity, such as labour. The marginal productivity of labour decreases as the amount of labour in a certain industry increases.

Heckscher Ohlin theory of international trade

This finding additional validated the claims by other economists who did not settle for the H-O concept. The H-O theory simply states that a country with a labour intensive economy will export goods produced by it, while a country which is abundant in capital will export capital produced items. The Leontief Paradox opposes this theory with the example of the United States, a capital abundant country. Thus, in terms of the H-O theory United States being a more capital intensive economy, should export goods produced by this capital.

Stolper-Samuelson Theorem

Even though the H-O model has undergone several tests over the years and has produced a wide range of outcomes, there is still much we may learn about the theory. Numerous economists have attempted to refute the model, yet the theory is still relevant in economics. Since there is no method for calculating a country’s capital, as many studies have noted, calculating the factor abundance ratio for a country is still exceedingly challenging. Before measurement of labour and capital levels within a particular good is especially challenging. The fundamental presumptions of Heckscher-Ohlin are contested by some.

Imports than exports perhaps because his analysis was concerned with only one country—the U. Had he considered U along with Japan, he would have found that U. Exports https://1investing.in/ were capital-intensive compared with the Japanese exports. A study attempted by Tatemato and Ichimura concerning Japan has confirmed the Leontief paradox.

Leontief can also be credited for his discovery of the Leontief Paradox and the Composite Commodity Theorem. They are firstly means of learning the general equilibrium characteristics of open economies. Travis explains the Leontief paradox with the assistance of U.S. trade coverage. He refers to the fact that U.S. commerce is highly protected, a reality even more true when Leontief the leontief paradox questioned the validity of the theory of: made his study than it’s today. This helps to analyze ripple effects all through an financial system as adjustments in demand for last items work their method up the supply chain. Leontief’s enter-output evaluation has been used by the World Bank, the United Nations, and the U.S. …intensive, became known as the Leontief Paradox because it disputed the Heckscher-Ohlin principle.

The Leontief Paradox is likely one of the most well-known and necessary contradictions within the historical past of economics. Leontief actually made an attempt to resolve the dilemma by claiming that American workers were more productive than those from other countries. Due to this, the United States exported items that required labour as opposed to goods that required capital. The Leontief Paradox is one of the most famous and important contradictions in the history of economics. Leontief also won a Nobel Prize in Economics for his input-output analysis in 1973. The input-output co-efficients and trade can have significant influence on the composition of production and structure of industries.